- Ziina launches its first digital card with Visa in the UAE, available in Apple Wallet.

- Funds received on Ziina can be spent instantly; no cash-out wait.

- Aimed at both SMEs and individuals, with enriched data and expense controls.

- UAE SMEs face cash-flow delays; Ziina says this closes the loop from getting paid to spending.

- Visa partnership brings global acceptance, security, and business rewards.

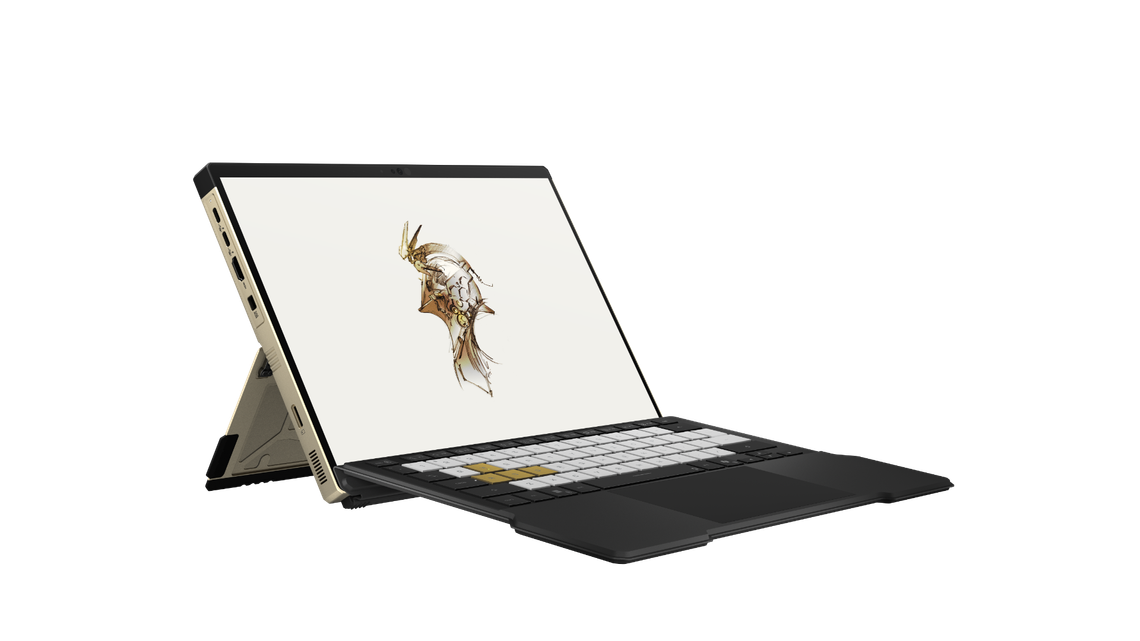

Ziina has launched Ziina Card, a digital card powered by Visa and available in Apple Wallet. It turns money received on Ziina into instant spending power. The move targets both SMEs and everyday users in the UAE, promising faster cash flow, richer transaction data and tighter expense control. The launch follows Ziina’s push into Tap to Pay, knitting together acceptance and issuing under one roof.

What is Ziina Card?

Ziina Card is a digital card that lives in Apple Wallet. It lets you spend from your Ziina balance as soon as funds arrive.

- First Ziina card, powered by Visa

- Works from Apple Wallet; tap to pay from your incoming funds

- Aimed at individuals and businesses in the UAE

- Global acceptance and security via Visa

Ziina describes the card as a way to make money movement faster and more contextual. It is available directly in Apple Wallet and turns a user’s Ziina balance into “instant spending power.” The Visa tie-up brings broad acceptance, security features and rewards.

“Your money, always accessible, working the way you need it to,” said CEO Faisal Toukan.

For broader context on Apple’s contactless rollout, see our recent coverage of Tap to Pay momentum. Tap to Pay on iPhone: software-only acceptance.

Why it matters for UAE SMEs

SMEs make up most companies in the UAE and still wrestle with delayed client payments. Ziina aims to close the gap between getting paid and paying out.

- SMEs are 94% of UAE companies and 63% of GDP

- Cash-flow lags slow down purchasing and operations

- Ziina connects acquiring, issuing and expenses in one place

- Enriched data improves visibility and accounting

The release points to persistent cash-flow issues in the market. By letting businesses spend incoming funds straight away, Ziina aims to eliminate the “cash-out” wait and the friction of juggling multiple providers. Each transaction carries merchant-level data, and expense controls sit in the same app.

If you’re comparing payment options and gateways, this guide is useful background: UAE SMEs’ path to payment gateways

How it works for everyday spenders

For individuals, the card turns peer-to-peer and other incoming payments into immediate spend.

- Spend instantly using Apple Pay anywhere cards are accepted

- Keep the social context of who, what and why

- See enriched merchant details in the app

- No hardware or separate bank transfer needed

Ziina says every dirham you receive can be used at once. Transactions keep the context from the payment request or split, while merchant details inside the app add clarity. It extends the same simple getting-paid experience into daily spending.

Rewards, security and availability

Visa brings the rails, security and commercial perks—Ziina layers on controls and licensing.

- Global acceptance and security features via Visa

- Discounts on tools like Microsoft 365, Google Workspace, Adobe Acrobat Pro, Freshworks, SignEasy and Zendesk

- Licensed by the Central Bank of the UAE

- Launch announced in Dubai on 29 October 2025

Visa’s UAE country lead calls out instant, secure and globally accepted spending. On top of that, businesses can access partner discounts for common SaaS tools. Ziina highlights Central Bank licensing and enriched data for trust and control. The launch was announced in Dubai on 29 October 2025.

For more on Visa’s regional activity, see our coverage of Visa’s Arabic AI push with Intella.

Part of a broader ecosystem

Ziina has been building towards a complete loop: accept money, then spend it, all in one place.

- Tap to Pay on iPhone and Android launched earlier this year

- Ziina positions itself as the only licensed startup connecting both sides

- Tens of thousands requested the card before launch

Tap to Pay on iPhone and Android turned eligible phones into acceptance devices without extra hardware. With Ziina Card, the company says it now completes the loop from acceptance to spend. The firm claims strong user demand ahead of launch.

If you follow UAE fintech for consumers, our look at a new app for the unbanked adds context on where the market is heading.

What is Ziina Card?

A digital card powered by Visa that lives in Apple Wallet. It lets users spend from their Ziina balance instantly, with global acceptance.

Who is it for?

Individuals and businesses in the UAE that receive money on Ziina and want to spend it straight away, with expense controls and enriched data.

Why does it matter for SMEs?

SMEs face cash-flow delays. Ziina links acceptance, issuing and expenses so funds can be used immediately for purchases, suppliers and day-to-day costs.

Are there rewards or perks?

Yes. Through Visa, Ziina says businesses can access discounts on tools such as Microsoft 365, Google Workspace, Adobe Acrobat Pro, Freshworks, SignEasy and Zendesk.

Is it licensed and secure?

Ziina states it is licensed by the Central Bank of the UAE and that Visa provides global acceptance and security. Each transaction includes enriched merchant data for visibility.

Subscribe to our newsletter to get the latest updates and news

Member discussion