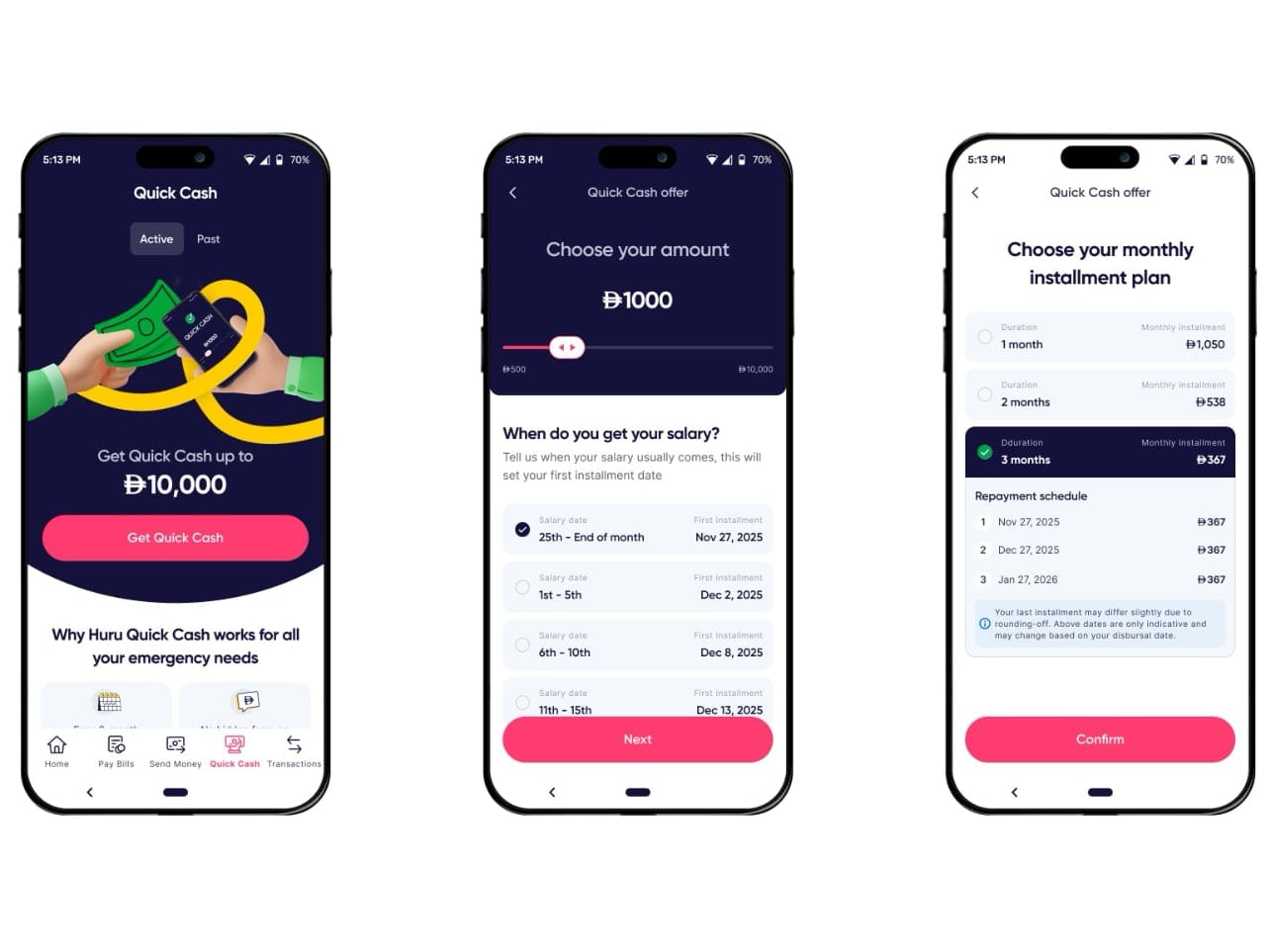

Huru has rolled out Quick Cash, an instant microfinance feature built for workers who either don’t have a traditional bank account or rarely get useful credit offers. The launch follows the UAE Central Bank’s updated personal lending framework and aims to plug a very local gap: people who get paid on time, but still struggle to access safe short-term finance.

If the name Huru rings a bell, we’ve already covered how the app targets unbanked workers in the UAE with zero-balance accounts, Visa cards and remittances. Quick Cash is the logical “next step” – it adds regulated borrowing to the stack, instead of sending people to loan sharks or random “salary advance” groups on WhatsApp.

- Huru has launched Quick Cash, an instant microfinance feature for unbanked and underbanked residents in the UAE.

- Users can access up to AED 10,000, repaid in monthly instalments with clear mark-up fees.

- Repayments are auto-deducted from Huru salary accounts, easing pressure on employers to give salary advances.

- The product is powered by a data-driven underwriting model and launched in partnership with Sharia-compliant Mawarid Finance.

- It aligns with the UAE Central Bank’s updated framework, which broadens who can access regulated personal lending.

What exactly is Quick Cash?

Quick Cash is Huru’s new Instant microfinance feature, built on top of its existing money app and salary account.

- Instant access to up to AED 10,000

- Short-term loans repaid via monthly instalments

- Low, transparent mark-up fees instead of confusing charges

- Funds disbursed instantly into the Huru account

- Designed around financial inclusion and Central Bank rules

In practice, a user with their salary coming into Huru can tap Quick Cash for a relatively small amount, get it almost instantly, and then pay it back over a few months via fixed deductions from their Huru salary account. It’s still debt, so it needs to be used carefully, but it’s at least regulated and visible – unlike many informal loans floating around labour camps and shared housing.

Who is it for – and how does it work?

Huru is very clear about who this is aimed at: unbanked and underbanked communities in the UAE – the people usually at the back of the queue when banks launch a “new” product.

- Focus on residents with limited or no traditional banking

- Eligibility based on salary inflows, spending patterns and self-declared data

- Uses alternative data and a machine-learning underwriting engine

- Prioritises responsible, inclusive lending decisions

Instead of just checking a classic credit score (which many low-income workers don’t even have), Huru looks at how money actually flows through the account – salary regularity, spending behaviour, and other data points. That feeds into its underwriting model, which then decides if someone gets access to Quick Cash and on what terms. The idea is to say “yes” more often, but still stay within responsible limits and Central Bank expectations.

Why this matters for financial inclusion in the UAE

The timing here is not random. The Central Bank of the UAE has updated lending rules to widen who can be offered personal finance products, and it continues to push digital, regulated solutions over informal workarounds.

- Aligns with the updated personal lending framework

- Offers regulated short-term finance instead of informal loans

- Targets workers often missed by traditional banks

- Supports national goals around financial inclusion and digital finance

We’ve seen this story build for a while. From Huru’s initial launch focused on unbanked workers to du Pay’s “salary in the wallet” push and the rise of BNPL as an alternative to credit cards, financial inclusion is now a visible theme in the UAE’s fintech roadmap. Quick Cash is another piece of that puzzle: same users, but this time the focus is on emergency liquidity, not just getting paid or splitting purchases.

A cleaner alternative to salary advances for employers

Quick Cash isn’t just a “user feature”. It’s also aimed squarely at employers who are tired of constant salary advance requests.

- Repayments are auto-deducted from employees’ Huru salary accounts

- Reduces manual salary advance processing for HR and payroll teams

- Helps improve employee morale, retention and financial stability

- Supports more predictable cash flow management for companies

Instead of HR scrambling to approve and track ad-hoc salary advances, employees can use a structured, app-based microfinance tool. For employers using Huru as a payroll channel, this can lighten admin load and help staff handle emergencies without awkward conversations every month. It’s not charity – but it’s a more sustainable system than the “envelope from accounts” routine.

Sharia-compliant backbone with Mawarid Finance

Quick Cash is launched in partnership with Mawarid Finance, a Central Bank–regulated, Sharia-compliant finance company based in Dubai.

- Mawarid is a Sharia-compliant financial institution, licensed and regulated in the UAE

- Known for ethical, transparent finance products

- Brings regulatory and Sharia oversight to Huru’s microfinance model

- Partnership structure helps keep Quick Cash within clear ethical and legal boundaries

Mawarid has been building Sharia-compliant products for individuals and SMEs for years, with its own internal Sharia supervision and a portfolio that already includes consumer and SME finance. By tapping that experience, Huru can focus on the tech, UX and data side, while Mawarid handles the heavy lifting on structure and compliance – a pattern we’re seeing more often as traditional finance and fintech team up across the region.

FAQs: Huru Quick Cash in the UAE

What is Huru Quick Cash?

Quick Cash is an instant microfinance feature inside the Huru app that gives eligible users access to up to AED 10,000 in short-term finance, with fixed monthly repayments and transparent mark-up fees.

Who can apply for Huru Quick Cash?

Huru says Quick Cash is designed for unbanked and underbanked residents in the UAE – mainly users whose salaries are paid into their Huru accounts and who may not qualify easily for traditional bank loans. Eligibility is assessed using salary inflows, spending patterns, self-declared data and other alternative data points.

How much can I borrow and how do repayments work?

According to Huru, users can access up to AED 10,000. Funds are disbursed instantly, and repayments are taken automatically from the user’s Huru salary account in monthly instalments, with low and clearly stated mark-up fees.

Is Huru Quick Cash Sharia-compliant?

Quick Cash is delivered in partnership with Mawarid Finance, a Sharia-compliant financial institution regulated by the Central Bank of the UAE. Huru positions the product as being aligned with ethical finance standards and regulatory requirements.

How is this different from a typical salary advance?

Salary advances are usually manual, informal and handled by employers on a case-by-case basis. Quick Cash is a regulated, app-based microfinance product with clear terms, structured repayments and automated salary deductions. It’s designed to reduce admin for employers while giving workers a safer, more transparent way to access short-term funds when they need them.

Subscribe to our newsletter to get the latest updates and news

Member discussion