The smartphone market's competitive dynamics are shifting from shipment volumes to long-term user retention, with eight leading OEMs now exceeding 200 million active devices each. According to Counterpoint Research's Smartphone Installed Base Tracker, only Apple and Samsung have crossed the one-billion active devices milestone, with Apple adding more net new devices than the next seven leading OEMs combined in 2025.

The billion-device club and strategic positioning

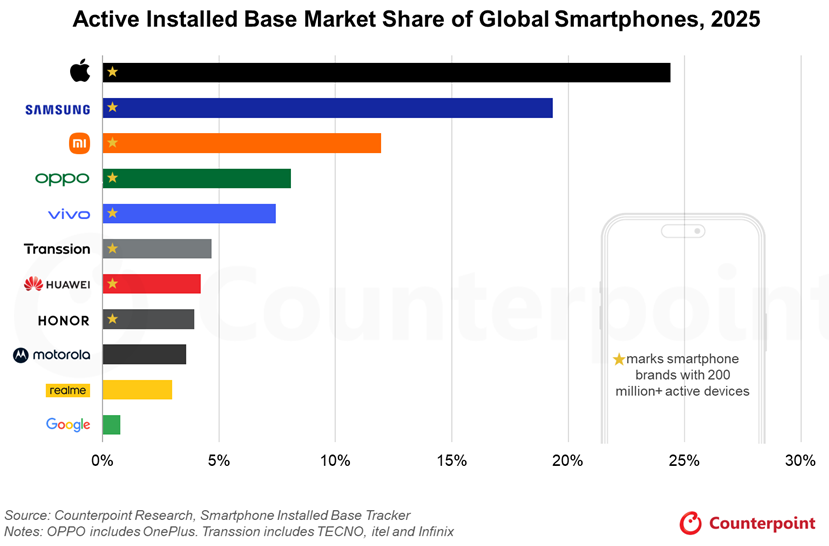

Apple leads with approximately 25% of the global active installed base, whilst Samsung holds around 20%. Together, they control 44% of all active smartphones globally — a dominance built on premium positioning and ecosystem lock-in rather than on sales volumes alone.

"Apple leads the global active installed base, with about one in four active smartphones being an iPhone. This is driven by strong user loyalty, a deep iOS ecosystem and tightly integrated services," said Karn Chauhan, Senior Analyst at Counterpoint Research. The company's ability to retain users becomes more valuable as services revenue continues delivering double-digit growth.

Samsung's position reflects its broad portfolio strategy, spanning entry-level to premium segments across an extensive geographic reach. This approach contrasts with Apple's premium-focused model but achieves similar scale through volume and market presence.

The 200 million club segments

Beyond the billion-device leaders, six other brands have crossed the 200 million threshold, creating what Counterpoint identifies as three distinct segments. Xiaomi, OPPO, and vivo form the second tier, having built large bases by targeting mid- and high-mid segments whilst strengthening their ecosystems.

Transsion Group represents the third segment, growing through affordable devices tailored to price-sensitive markets including the Middle East and Africa. HONOR recently became the eighth member of this exclusive club, whilst Motorola and realme are approaching the milestone.

"Only Apple and Samsung have surpassed the one-billion active devices milestone, showing their ability to keep users engaged over time," noted Tarun Pathak, Research Director at Counterpoint Research. This user retention advantage becomes more critical as hardware differentiation diminishes.

Extended replacement cycles reshape competition

The global active smartphone installed base grew just 2% in 2025, driven by replacement cycles extending to nearly four years and increasing second-life device usage. This shift fundamentally changes competitive dynamics — success now depends on device longevity and user retention rather than annual sales peaks.

Premium devices drive this trend through durable builds, extended software support, strong resale values, and integrated ecosystems. These factors extend active device lifespans and encourage multi-owner usage, widening the gap between premium and budget manufacturers.

For UAE consumers, this trend aligns with the region's growing smartphone adoption and preference for premium devices that maintain value over time. Extended replacement cycles mean purchasing decisions carry greater long-term implications.

Premium segment challenges and AI differentiation

Despite premiumization trends, competing in the premium segment remains difficult. In 2025, six OEMs outside Apple and Samsung held only a single-digit sales share in the premium segment above a $600 wholesale price. Memory shortages and rising component costs further limit the availability of higher-specification models.

Differentiation is shifting to software and ecosystem layers in the AI era. On-device AI, camera intelligence, productivity features, and cross-device integration become key value drivers that build loyalty and drive increased usage.

"Growing the active installed base and extending device lifespans strengthen software revenue potential, turning each smartphone into a long-term monetisation platform," the research notes. Apple remains the only brand consistently generating high-margin revenues from its installed base, highlighting the strategic value of ecosystem lock-in.

Market implications for UAE

These global trends suggest UAE consumers are likely holding devices longer, valuing durability and integrated services over frequent upgrades. As smartphone prices increase, the emphasis on long-term value becomes more pronounced for local buyers and retailers.

Frequently Asked Questions

Which smartphone OEMs have the largest active installed base?

Apple and Samsung each have over one billion active devices, leading the global market. Eight OEMs in total have over 200 million active devices, together accounting for more than 80% of the global active installed base.

What was the global active smartphone installed base growth in 2025?

The global active smartphone installed base grew by 2% in 2025, driven by replacement cycles extending to nearly four years and increasing second-life device usage, according to Counterpoint Research.

Why is Apple adding more net new smartphone devices than competitors?

Apple's strong user loyalty, deep iOS ecosystem, and tightly integrated services contribute to superior user retention. In 2025, Apple added more net new devices than the next seven leading OEMs combined.

How do premium smartphones maintain user retention?

Premium devices achieve longer retention through durable builds, extended software support, strong resale values, deeply integrated ecosystems, and powerful brand loyalty that extends device lifespans and encourages multi-owner usage.

Subscribe to our newsletter to get the latest updates and news

Member discussion